If you've spent any time researching Amazon FBA prep centers, you've probably seen it: "Located in a 0% sales tax state!" marketed as a major selling point. The implication is clear—use our prep center and save money on sales tax. But here's the truth most sellers don't realize: this "benefit" is largely irrelevant for legitimate resellers. Let me explain why.

The Reseller Certificate: Your Built-In Tax Exemption

If you're running a legitimate reselling business with an EIN, you likely qualify for something that makes the "0% sales tax state" argument irrelevant: a reseller certificate (also called a resale certificate or sales tax exemption certificate).

A reseller certificate allows you to purchase inventory without paying sales tax—regardless of where you or your prep center are located. The logic is simple: sales tax is meant to be collected from the end consumer, not charged at every step of the supply chain. When you buy products specifically to resell them, you're not the end consumer.

Obtaining a reseller certificate is typically straightforward. You apply through your state's Department of Revenue or equivalent tax authority, usually the state where your business is incorporated, where you have a tax nexus, or in the case of using a prep center, the state where the prep center is located. The process is often free or low-cost, and many states offer online applications that can be completed in minutes.

Alternatively, you can use the Streamlined Sales and Use Tax Agreement (SSUTA) Certificate of Exemption. Instead of using different exemption forms for each state, eligible purchasers can use this single, uniform certificate across all 24 Streamlined Sales Tax member states. In either case, the process is very simple—the certificate is not required to be filed with any state or governing agency but rather needs to be provided to the seller directly.

Major Retailers Accept Tax Exemption Certificates

Here's something that surprises many new sellers: most major retailers—both online and brick-and-mortar—have formal programs to accept reseller certificates. This means you can source inventory tax-free from the places you're already shopping. Below are some of the major ones:

Online Marketplaces

Amazon Tax Exemption Program (ATEP): Amazon's program allows qualified businesses to make tax-exempt purchases. Enroll at Amazon Tax Exemption Program (ATEP)

Walmart Tax Exemption Program (WTEP): Works for both Walmart.com and in-store purchases. Enroll at Walmart Tax Exemption Program (WTEP)

eBay Buyer Exemption Program for Sales Tax: You can simply upload your tax exemption documents at eBay Buyer Exemption Program

Major Retail Chains

Home Depot: Tax-exempt purchases available online and in-store. Register at Home Depot Tax Exempt Registration

Lowe's (Tax-Exempt Management System - TEMS): Online and in-store enrollment. Register at Lowe's TEMS

Best Buy (Tax-Exempt Customer Program): Available for online and in-store purchases. Learn more at Best Buy Tax Exempt Registration

Sam's Club: Tax exemption available online and in-club. Enrollment instructions are available at Sam's Club Tax Exemption

Office Depot / OfficeMax: Online and in-store program. Register at Office Depot Tax Exemption

BJ's Wholesale: In-club enrollment with business-friendly policies. Details at BJ's Tax Exempt Program

Costco: For Costco.com purchases, you may need to request reimbursement of sales tax paid. See their policy at Costco Tax Exempt FAQ

Note: These are just a snapshot of the offerings. All major retailers or wholesalers would have a process to enable resellers (online and in-store) to purchase merchandise for resale without having to pay for sales taxes as per the law. While these programs exist, implementation can vary by location and associate familiarity with the process. Some stores may require manager approval or have specific procedures to follow. It's always good to have your documentation ready.

What if I Don't Have a Reseller Certificate?

So, what happens if you don't have a reseller certificate or can't obtain one? In some circumstances, you may be able to benefit from your prep center's reseller certificate if they have one. This can be an option worth exploring, particularly for certain purchasing scenarios. At PrepMeisters, we do have a reseller certificate and can discuss how this might work for your specific situation.

However, relying solely on a prep center's tax status—whether through their reseller certificate or their state location—shouldn't be your primary consideration when choosing a prep partner.

What Actually Matters When Choosing a Prep Center

If the "0% sales tax state" benefit is largely a non-factor for most sellers, what should you actually be evaluating? Here's what makes a real difference to your bottom line:

Prep Quality and Compliance Expertise

A rejected shipment costs far more than any sales tax savings. Look for prep centers with demonstrated expertise in Amazon's requirements—ideally with staff who understand FC operations from the inside. The cost of one rejected shipment during Q4 can dwarf any theoretical tax savings over an entire year.

Turnaround Time and Communication

How quickly can your inventory get processed and shipped? How easily can you get updates and resolve issues? These operational factors directly affect your cash flow and selling velocity.

Proximity to Amazon Fulfillment Centers

Shipping costs are a real, recurring expense that directly impacts your margins. A prep center located near major Amazon FCs means shorter shipping distances, lower freight costs, and faster inventory availability.

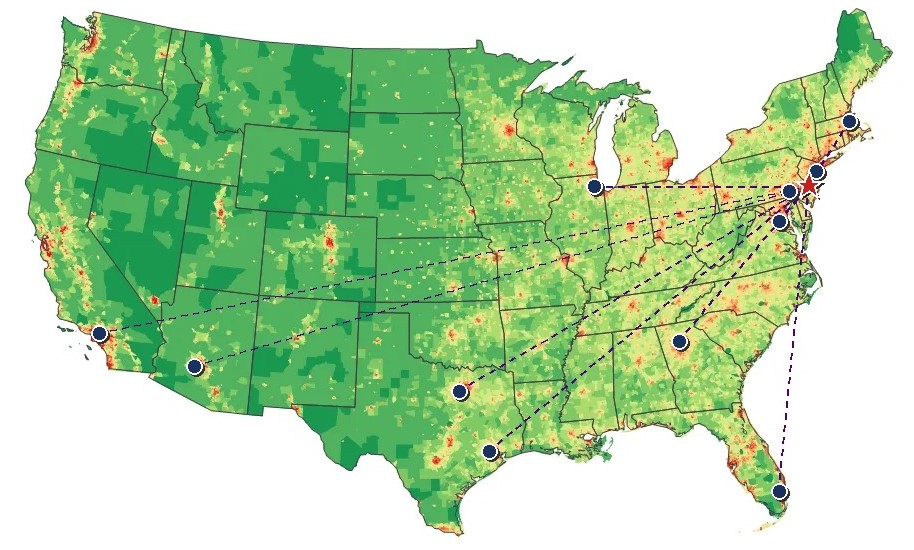

The Northeast corridor, for example, has one of the highest concentrations of Amazon fulfillment centers in the country. A prep center in New Jersey can reach multiple FCs within hours, not days and at very attractive shipping costs.

Access to Major Population Centers

Beyond FC proximity, consider where your suppliers are shipping from and where your customers are located, especially if you are using the Fulfilled By Merchant (FBM) model. Approximately 40% of the U.S. population lives within a day's drive of the New York/New Jersey metro area. The Port of NY/NJ is also the largest port on the East Coast—if you're importing products, a nearby prep center can significantly reduce your logistics costs and complexity.

The Bottom Line

The "0% sales tax state" pitch sounds compelling, but it's often a solution to a problem that doesn't exist for prepared sellers. With a reseller certificate—which you should have anyway if you're running a legitimate reselling business—you can purchase inventory tax-free regardless of where your prep center is located.

Instead of chasing tax-free states, focus on what actually moves the needle: a prep center with the right location for efficient shipping, the expertise to keep your shipments compliant, and the operational excellence to keep your inventory flowing.

That's where the real savings are.

Ready to Get Started?

Let PrepMeisters handle your Amazon FBA prep with the expertise that comes from a decade inside Amazon. 100% compliant prep, every time.

Get a Free Quote